A complete guide to voice of the customer programs

Everything you need to know to capture, analyze, and act on customer feedback

Last updated: November 2025

A voice of the customer (VoC) program captures customer feedback across every interaction to reveal what people really think, feel, and need from your product. The best programs go beyond collecting data — they uncover customer motivations, connect insights to product strategy, and close the feedback loop with clear communication. This guide explains how to build a scalable, continuous VoC program that drives product and business growth. |

Definition: The voice of the customer (VoC) is the process of gathering and interpreting customer feedback to understand their needs, preferences, and experiences — and using that insight to guide product and business decisions.

What is the voice of the customer?

The voice of the customer (VoC) is how you learn what truly matters to the people using your product. It turns everyday feedback into a deeper understanding of their needs, frustrations, and motivations — so you can make decisions rooted in reality, not assumptions.

At its core, VoC is a continuous listening practice. You gather insights from multiple sources — surveys, interviews, support tickets, sales conversations, product usage data — and synthesize them all into a diagnostic of customer sentiment and priorities. This understanding should be shared broadly with the team and inform everything from product strategy to go-to-market activities.

Collecting feedback is just the starting point. The real work is uncovering what drives customer behavior and what problems are worth solving.

The best product teams seek to understand the heart of the customer: the hopes, desires, and challenges behind every piece of feedback. They also evaluate input carefully, assessing what creates actual value for the business, the product, and the customer rather than implementing requests without vetting them.

This guide offers a comprehensive VoC overview, including how to build your own voice of the customer program and how to evaluate your team's readiness:

Examples of voice of the customer sources

Customer insights exist everywhere in your organization — literally everywhere.

The problem isn't listening to customers. It is knowing where to engage, what to ask, and how to capture gems of insight without drowning in noise. Think of it this way: Anyone can set up a survey. Not everyone can gather broad feedback from different sources, mine for patterns, and understand what will deliver the most value.

These are the most common voice of the customer sources product teams use to collect feedback and customer insights:

Ideas portals and feedback tools: Dedicated platforms where customers submit and vote on feature requests

Online surveys and net promoter score forms: Net promoter scores (NPS), customer satisfaction (CSAT) scores, and custom surveys sent via email or in-app

Customer reviews and social proof: Feedback on websites, app marketplaces, and social media

Focus groups and customer interviews: Structured conversations with the product team

Product usage analytics and behavior data: Data showing how customers actually use your product

Support interactions: Phone calls, chat conversations, emails, and support tickets

Sales conversations: Feedback from the field, conversations with prospects, as well as closed deals

Community forums and social listening: Platforms where customers discuss your product and industry

Related:

Voice of the customer best practices

Product builders all share certain traits. You are curious about problems, systematic in your thinking, and committed to deeply understanding the people who ultimately use what you build. Those traits also inform skills and best practices related to VoC activities:

You focus on problems, not solutions: Customers frame feedback as feature requests. Your job is to dig deeper and understand the underlying problem. Often, the best solution is different from what customers initially suggest.

You seek feedback at scale and depth: Breadth tells you what customers want. Depth tells you why. Cast a wide net with portals and surveys to understand broad priorities. But you also go deep with targeted research (like empathy sessions and customer interviews).

You review every piece of feedback: When customers know you're reading their feedback, they provide richer input. The product team at Aha! is committed to reviewing customer requests weekly. This level of discipline ensures nothing falls through the cracks and helps you spot patterns.

You categorize and tag systematically: Without structure, valuable insights get buried. Organize feedback by feature area, customer segment, or problem type. Then, add status labels to track progress.

You connect insights to roadmap decisions: Customer insights are directly linked to your roadmap. Integrated product development software makes this seamless. For example, when you promote a high-value idea to a roadmap feature in Aha! Roadmaps, you create traceability from customer insight to delivered feature.

You close the feedback loop: Respond to customers even when you have to say no. Explain your reasoning and share roadmap updates when appropriate. This transparency builds trust and encourages ongoing participation.

You make insights accessible across teams: Share customer feedback broadly. Help sales to understand product direction, support to see which pain points are being addressed, and give engineering deeper empathy for the problems they're solving.

You measure what matters: A VoC program that generates beautiful reports, but offers little impact is merely performative listening. Track submission volume, participation rates, time to respond, and whether you're building features that drive customer love and business outcomes.

Related:

What is a voice of the customer program?

Definition: A voice of the customer program is a structured process for collecting, analyzing, and acting on customer feedback to inform product, marketing, and customer experience decisions.

Think of a VoC program as the infrastructure that turns scattered customer conversations into strategic advantage.

A VoC program transforms the listening practice we have described into a strategic process for systematically gathering, analyzing, and acting on customer feedback throughout the product development process. By collecting information from diverse sources and applying your learnings to business decisions, VoC programs help companies improve products, services, and the overall customer experience.

Before we dive into the details of what a VoC program is and how you can set up and scale your own, let's clear up some misconceptions.

What a voice of the customer program is not

A survey tool: Tools are important, but a VoC program is a practice that requires intention. You can't run one with a suite of tools and no repeatable process.

A project with an end date: This is ongoing infrastructure for customer research understanding, not a one-time customer feedback session.

About building everything customers request: A VoC program helps you understand customer problems, not implement their proposed solutions. Sometimes the answer is "no." The program gives you the context to make that decision confidently and explain it clearly.

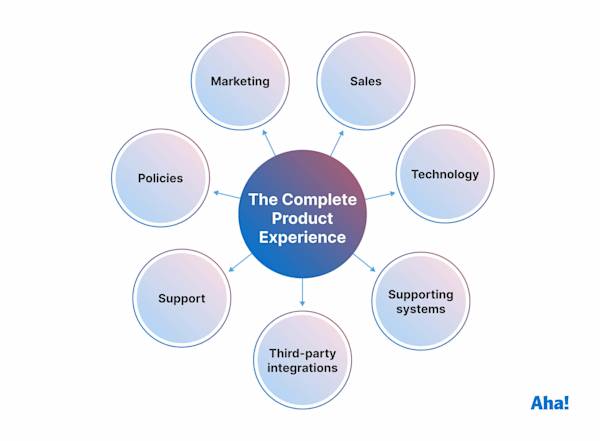

Only for product teams: Treating this as "a product thing" wastes most of the value. VoC insights should inform marketing positioning, sales tactics, support documentation, pricing strategy, and customer success playbooks.

4 essential components

Now that you know what a VoC program is not, let's look at what actually makes one work. Every effective program has four essential components that work together to turn customer conversations into strategic decisions:

1. Systematic collection across channels

A VoC program establishes consistent methods for gathering feedback. The program defines both how feedback flows into your organization and who is responsible for capturing it.

This includes both:

Passive collection: Ideas portals, support tickets, reviews

Active outreach: Scheduled interviews, surveys, research sessions

2. Structured analysis and synthesis

Raw feedback is noise. A VoC program includes a repeatable process for turning that noise into signal. This is where you move from "some customers mentioned this" to "here's a trend we need to address."

Analysis and synthesis include:

Categorizing inputs

Connecting related feedback

Identifying patterns

3. Clear connection to decision-making

The defining characteristic of a VoC program is that customer insights actually influence decisions. There's a traceable line from "customers told us X" to "we're doing Y."

4. Closed-loop communication

Programs include mechanisms for telling customers what happened with their input. Status updates, roadmap transparency, and responses to feedback requests are built into the process — not treated as optional or a bonus when someone has time.

Who runs a voice of the customer program?

Someone has to wake up every day thinking about customer insights. Not as one of 15 to-dos, but as the most important task of the day.

The structure and ownership of a VoC program vary by organization size and maturity:

Organization | Typical ownership | VoC program |

Early-stage startups | Founders |

|

Growing companies | Product manager or product marketing manager |

|

Mid-size companies | Product operations or customer insights role |

|

Enterprise companies | VoC team or center of excellence |

|

Voice of the customer tools

You want to avoid the trap of buying a bunch of disparate tools and losing your VoC efforts to software sprawl. Start with what you will actually use, then expand as your VoC program matures. The following table shows what to look for when evaluating VoC software solutions:

Function | What it does | When you need it |

Ideas management |

| Always |

Research and discovery |

| For regular customer research and spotting patterns |

Survey and polling |

| To measure sentiment at scale |

In-app feedback |

| To understand specific workflow pain points |

Product analytics |

| To see what customers do vs. what they say |

Support and CRM |

| To mine existing data before asking more questions |

Recommended approach

The best approach often involves leveraging purpose-built tools to create a complete picture. Comprehensive product development software like Aha! can dramatically improve your ability to gather, analyze, and act on customer feedback.

Customer feedback and voting: Aha! Ideas provides a central place for customers to submit ideas, vote on requests, and engage with your team. It includes features for organizing feedback, analyzing trends, and most importantly, closing the loop with status updates.

Research and discovery: Aha! Discovery helps product teams coordinate customer research, analyze interview transcripts, and surface insights during planning. These tools make it easier to move from scattered research notes to actionable strategic decisions.

Centralizing insights: Aha! Knowledge helps teams document and share customer insights, research findings, and product decisions in one place. This ensures VoC insights are accessible across the organization and don't get lost in individual notebooks or scattered documents.

Connecting insights to delivery: Aha! Roadmaps lets you connect customer feedback directly to features on your roadmap, creating traceability from customer need to shipped solution.

Related:

Voice of the customer in action: A practical example

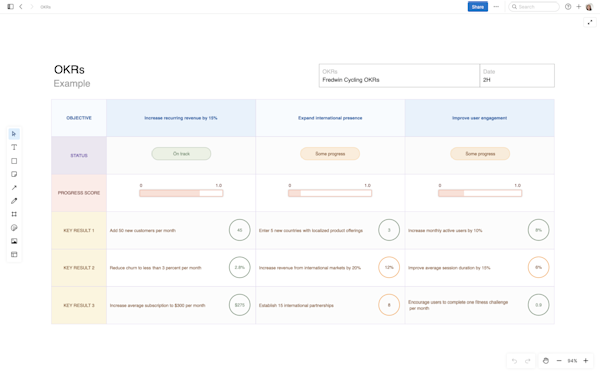

Every successful VoC program centers on three core activities:

Collection: Gathering feedback through multiple channels

Analysis: Identifying patterns and trends

Action: Applying insights to decisions

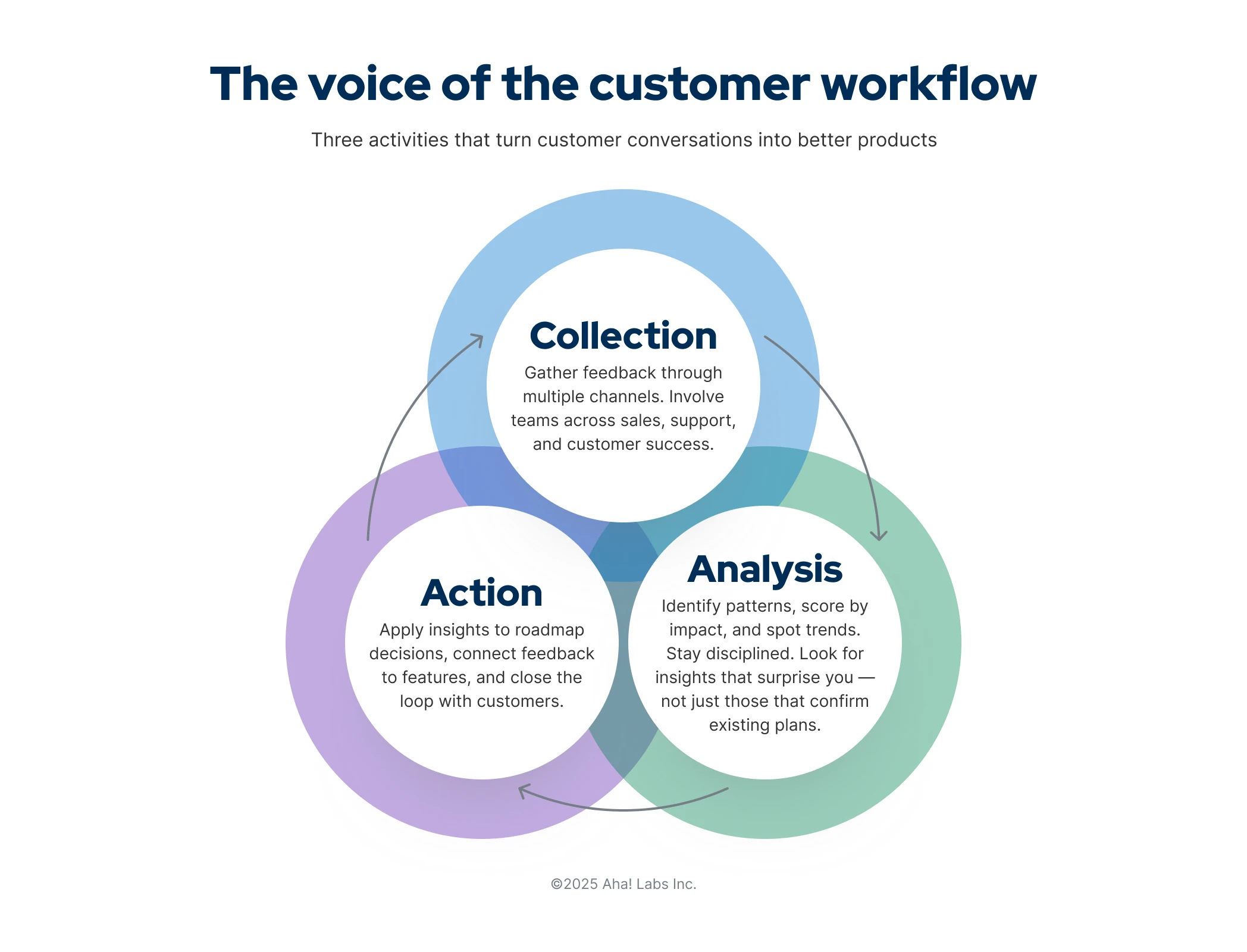

Let's look at how this works in practice. Consider how Fredwin Cycling, a fictional fitness app company, used its VoC program to avoid building the wrong feature:

The situation

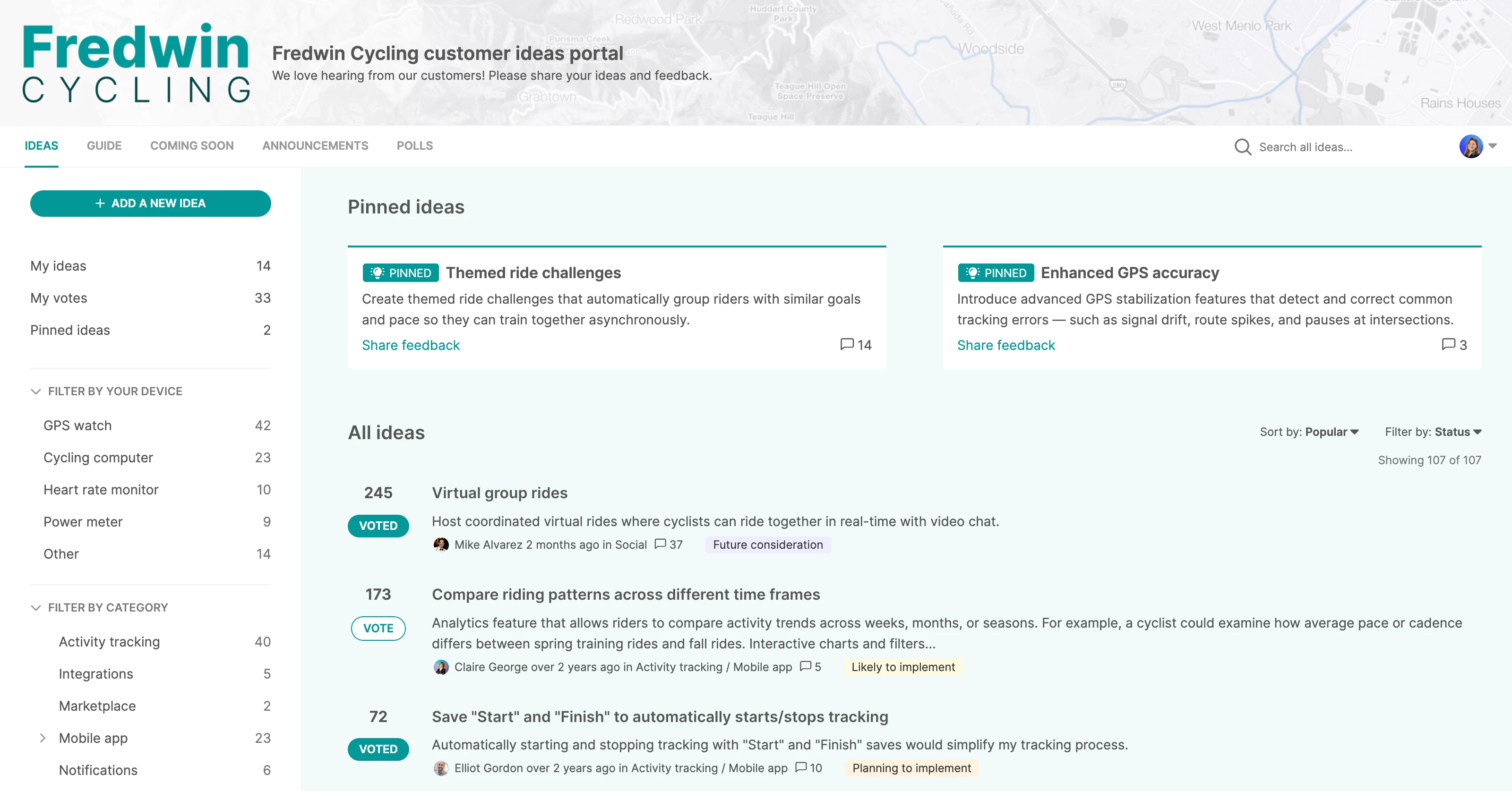

Fredwin Cycling's ideas portal showed strong demand for "virtual group rides" — the ability to ride with friends in real-time with video chat. Over several months, 89 users submitted ideas about group rides, and the requests accumulated more than 350 votes in the ideas portal. The feature seemed like an obvious priority, especially since a competitor recently launched similar capabilities.

A view of popular ideas about virtual group rides collected through Fredwin Cycling's dedicated ideas portal

Surface-level product response

A knee-jerk reaction would be to build virtual group rides with video. Users asked for it, competitors have it, and customer feedback seems to back it up (via ideas and votes).

What the VoC program revealed

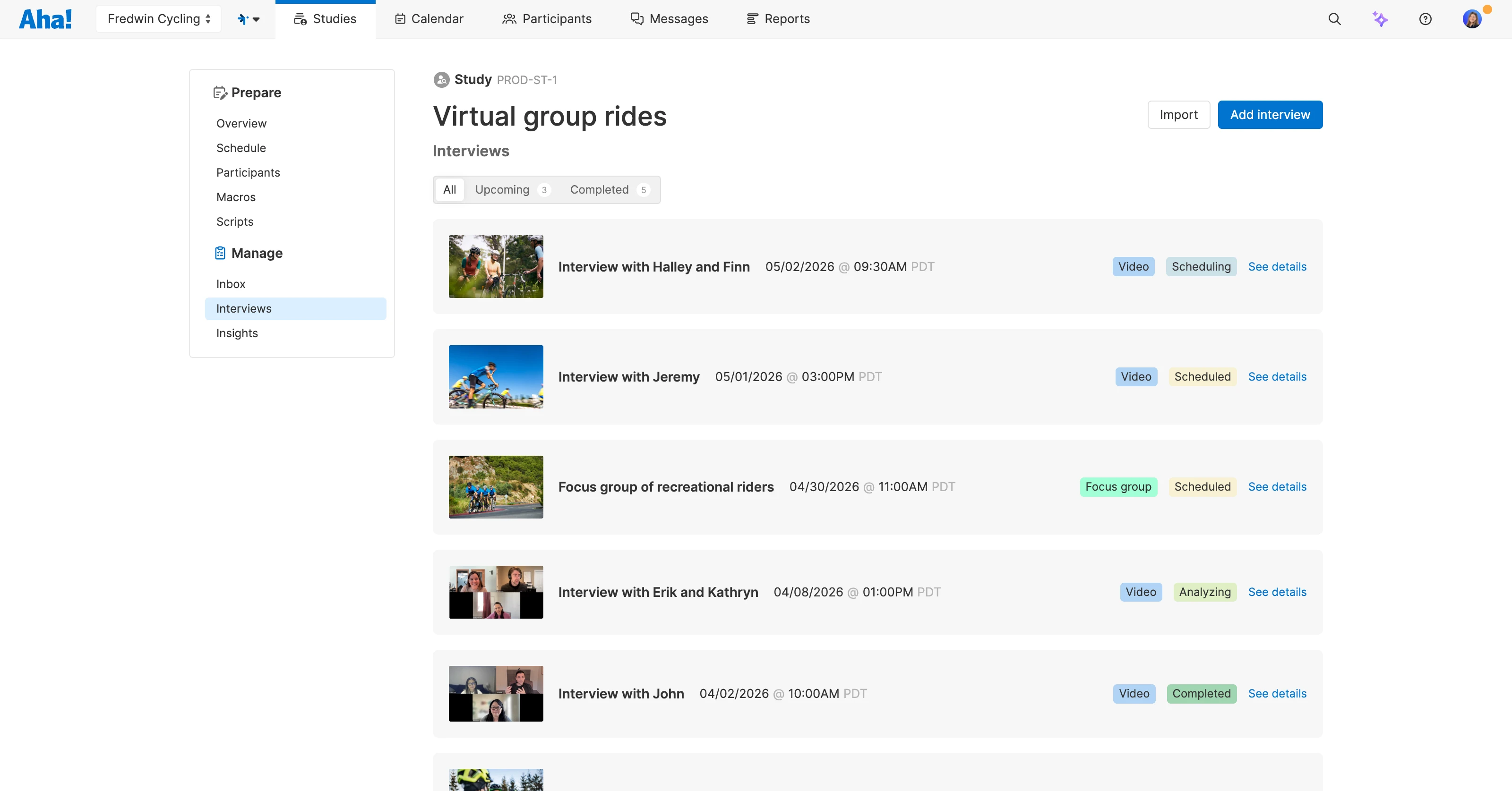

The product team launched a lightweight in-app poll about virtual group rides and scheduled conversations with users who had voted on the idea. Through deeper conversation and analysis, they discovered:

Only a few actually wanted live video chat while riding.

Most actually wanted ways to stay motivated and accountable with their friends.

A few wanted to compete with friends asynchronously (they couldn't coordinate schedules for live rides).

The majority described the core problem as "I lose motivation when I'm riding alone" and "I want to know how my friends are doing."

A view of all interviews scheduled in Fredwin Cycling's virtual group rides study

VoC product response

The problem wasn't about video technology — it was about connection and motivation. Instead of building a complex live video feature, the product team:

Added activity feeds so users could see and react to friends' completed rides

Built challenges where groups could compete on total distance or elevation over a week

Created post-ride kudos and comments

Added simple ride scheduling so friends could plan to ride at the same time

The outcome

User engagement increased 25% among people who connected with friends.

VoC best practices make a difference

Fredwin Cycling had implemented several of the best practices we outlined earlier:

Teammates reviewed every idea submission.

They categorized the group ride requests and noticed they came from different user segments with different motivations.

When voting concentrated on this idea, they didn't just build it. They paused to understand the underlying issue.

They connected insights directly to roadmap decisions and, ultimately, shipped a solution that addressed the real need.

Without the VoC program, they likely would have spent months building a video feature that most users didn't actually want — while ignoring simple social connection features that actually drove real engagement and value.

Related:

Making the business case for a voice of the customer program

Convincing leadership to invest in a voice of the customer program requires more than enthusiasm about listening to customers. There are a few approaches to making the business case for a VoC program:

Connect to business outcomes.

Propose a pilot to show ROI.

Anticipate and address objections.

Connect to business outcomes

The following table outlines how you can connect VoC to outcomes executives care about: revenue, retention, and competitive advantage:

Business challenge | How VoC addresses it | Metrics to track |

High churn rate | Identify and fix pain points before customers leave. |

|

Low feature adoption | Understand what customers actually need vs. what you built. |

|

Lost deals to competitors | Surface competitive gaps and objections earlier. |

|

Expensive support costs | Build what customers need instead of patching problems. |

|

Slow product-market fit | Validate assumptions before building the wrong thing. |

|

Propose a pilot to prove ROI

Don't propose a full program immediately. Instead, suggest a lightweight pilot that demonstrates value. Be able to clearly articulate what you are building and why it matters:

Focus area | What you're building/doing | Why it matters |

Set up infrastructure and invite first customers | Ideas portal, categories, initial participants | This is the foundation you need for a successful VoC program. |

Collect feedback and conduct interviews | Aiming for at least 20 ideas | You need a volume of feedback to actually mine for patterns and insights. |

Analyze patterns and identify top themes | Which problems appear most often? | Insights are what will drive more strategic product decisions. |

Share findings and make one decision based on VoC | Showing that the program drives real action | The more you can tie these insights to tangible value, the more credibility you build — for yourself and for the program. |

Here is a checklist for how you could do this over a six-month period:

Month 1-2: Run a focused initiative

Pick one high-impact area.

Interview 10-15 customers about this specific problem.

Identify three to five actionable insights.

Share findings with stakeholders.

Month 3-4: Act on insights and measure impact

Implement one or two changes based on what you learned.

Track the business metrics tied to those changes.

Document the ROI.

Month 5-6: Make the case for expansion

Show the pilot results to leadership.

Demonstrate concrete business impact.

Request budget and resources to scale the program.

Anticipate and address objections

"We already talk to customers during sales/support calls." Ad-hoc conversations miss patterns. A VoC program ensures insights reach the people making roadmap decisions — not just the people having the conversation.

"We don't have time/budget for this." What's the cost of building the wrong thing? One dud of a feature will cost significantly more than a VoC program.

"Customers don't know what they want." True. Customers are terrible at designing solutions. But they're excellent at describing problems. A VoC program helps you understand the pain, not implement their proposed fixes.

"We're too small/early for this." Actually, early-stage is the perfect time. When you have 50 customers, you can talk to all of them. Waiting until you have 5,000 customers makes this infinitely harder. Build the muscle now.

Related:

How to build a voice of the customer program

Ready to stop guessing and start knowing what customers actually need? This practical action plan will help you launch a VoC program, even if you're starting from scratch.

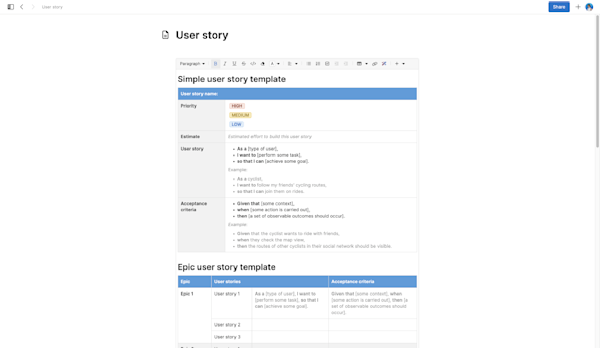

Step 1: Define what success looks like

Your goals will determine which feedback sources matter most and how you'll measure impact. Get clear on what you're trying to accomplish:

Are you trying to reduce churn?

Improve a specific feature?

Understand why prospects don't convert?

Then, set your targets:

Specific, measurable objectives

Alignment with broader company goals (pick one or two focus areas)

Clear timeline for evaluation (quarterly reviews work well)

Step 2: Choose your initial feedback channels

You don't need to deploy every feedback method on day one. Start with a few channels that will work with your available resources and match where your customers are:

Your situation | Best starting channels | Why this works |

Early-stage product, small customer base |

|

|

Established product with many potential directions to pursue |

|

|

High support volume |

|

|

Enterprise customers with specific needs and set renewals |

|

|

Freemium/self-serve |

|

|

Step 3: Set up your infrastructure

This is where most programs stall out, so don't let perfect be the enemy of done. You need three things to start:

A place to collect feedback: This could be as simple as an ideas portal, shared email inbox, or form. Just make sure it's centralized and not scattered across 50 different docs.

A way to organize what you collect: Create basic categories (by feature area, by customer segment, by problem type, etc.). Use tags liberally. Future you will thank present you when you're trying to find all the feedback for a specific area of your product.

A review cadence: Block time every week to actually look at feedback. Put it on your calendar like it's a meeting with your most important customer (because it basically is). The product team at Aha! reviews 20-30 requests every single week. No exceptions.

Step 4: Start small and build momentum

Launch with a pilot before rolling everything out companywide. Pick one product area or customer segment and prove the concept works. This gives you:

Permission to iterate without high stakes

Real examples to show skeptics that a VoC program actually drives decisions

Confidence before asking the entire company to change workflows and behavior

Step 5: Close the loop

What separates programs that thrive from those that languish? You tell customers what happened with their feedback. Even — especially — when the answer is "no."

What to communicate:

Thank them for sharing (sounds obvious, but people often skip this).

Explain what you're doing with the feedback (even if the answer is "under consideration").

Share decisions and reasoning (transparency builds trust).

Update them when statuses change (shipped, delayed, or deprioritized).

Tools like Aha! Ideas can automate status updates that notify everyone who voted on or commented on an idea, which scales far better than manual emails.

Step 6: Measure and adjust

After your first month or quarter, evaluate these things with honesty:

Are you actually reviewing feedback consistently?

Have you made any decisions based on what you learned?

Do customers know you're listening?

Are patterns emerging that inform product strategy?

If you said no to any of these, something needs to change. Maybe you need executive buy-in, different tools, or to reduce scope so you can focus on getting the basics right. The worst thing you can do is keep running a program that generates reports nobody reads.

Common early mistakes in VoC programs and how to fix them

Mistake | Issue | How to fix |

Collecting feedback but never analyzing it | No dedicated owner or time | Assign someone to own this and block recurring time. |

Analysis paralysis (waiting for perfect insights) | Fear of making the wrong decision | Start with obvious patterns, then iterate based on results. |

Only sharing findings in quarterly presentations | Treating VoC as a project vs. a practice | Share bite-sized insights weekly in standups or your workplace's messaging platform. |

Building what customers ask for verbatim | Mistaking solutions for problems | Dig deeper in interviews to understand the "why." |

Only talking to "happy" or vocal customers | Survivorship bias | Actively seek out detractors and churned customers. |

Moving from voice of the customer to the heart of the customer

Great teams move beyond asynchronous data collection to have real conversations. Building relationships with customers through genuine curiosity and empathy becomes as important as the technical work of organizing feedback.

This work requires dedication. Reviewing feedback consistently, scheduling research instead of just shipping, saying no to customer requests that don't align with strategy — this often doesn't come naturally. But understanding customers deeply transforms how product teams operate. It builds lasting loyalty, clarifies roadmap priorities, and reveals opportunities that your competitors may miss.

The voice of the customer is your starting point. Understanding the heart of the customer is where real product love begins.

FAQs about voice of the customer

Use a mix of methods that fit your customer base. Surveys and ideas portals show common requests at scale. Interviews and support conversations reveal what people actually struggle with. Consistent review — not more channels — is what makes a program effective.

Aha! software brings structure to the entire feedback loop:

Aha! Roadmaps: Link feedback to strategy and visualize what will deliver the most value.

Aha! Discovery: Organize and analyze research to uncover customer needs.

Aha! Ideas: Gather, sort, and analyze feedback from customers and teammates.

Aha! Knowledge: Share findings across the company so insights guide future work.

Together, these tools create transparency from idea to delivery — the foundation of a sustainable VoC program.

Tie the VoC program directly to business outcomes. A well-run program reduces churn, increases product adoption, and improves team efficiency. Prove the concept with a pilot — pick one customer segment, analyze a recurring issue, and show measurable results.

Collecting data without analysis, treating feedback as feature requests, or letting insights sit in silos. The strongest programs review input weekly, look for patterns, and connect findings to actual decisions.

Ownership varies by company size. In early-stage teams, product managers usually lead it. As the company grows, a dedicated product operations or customer success role may manage the process — ensuring feedback reaches everyone who shapes the product.

Be transparent. Acknowledge the request, explain your reasoning, and share what you are focusing on instead. Customers value honesty and are more likely to keep sharing input when they know their feedback is taken seriously.

A strong VoC program feeds discovery. Customer feedback identifies where to explore further, while discovery research validates which solutions will create the most value. Together, they create a cycle of learning that keeps your roadmap relevant and customer-centered.