Whether you are exploring churn, validating a concept, or identifying usability gaps, the participants you choose matter. This guide breaks down how to select the right customers based on your learning goals and build a system you can use again and again.

Skip ahead to any section:

User interviews vs. customer interviews

Are these the same thing? In practice, people often use "user interviews" and "customer interviews" interchangeably — we do too. Still, it can help to pause and clarify the difference, especially as you plan who to talk to next.

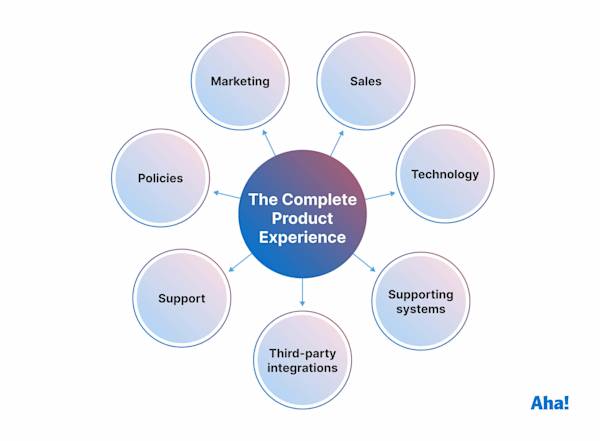

A user interview is all about the folks who get hands-on with your product. Power users, dabblers, free trial explorers, even people on your own team. The focus is pragmatic: What do people like? Where do they hit snags? What features would help them accomplish more? In these types of discussions, you want to understand users' actual experiences day-to-day.

A customer interview can go broader. These conversations might involve decision-makers or buyers — people who may never use the product directly but influence the purchase. Here you are listening for business goals, challenges, and the motivations that drive someone to choose your product.

Yes, we just drew a distinction between user and customer interviews, but do not get hung up on the terminology. What matters is that you are learning from the people whose feedback will shape your product, whether they are users, customers, or both.

Define your discovery interview objective

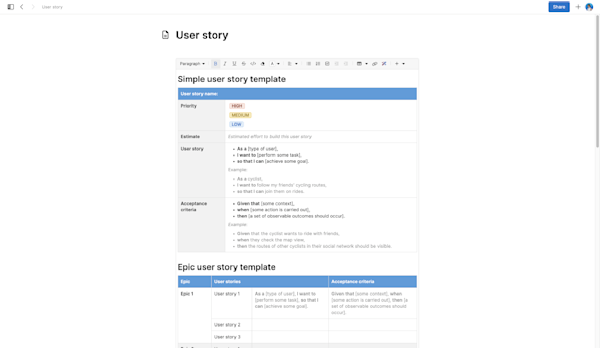

Every discovery effort should start with a specific learning goal. What do you want to understand? Why now? (A customer interview template can help you organize your thoughts.)

Different types of discovery work require different types of input. If you are looking for fresh ideas, you need to speak with people who see your product from a new angle. If you are trying to understand why something is not working, you need to hear directly from those feeling the friction.

At Aha! we think about user interviews in four broad categories, each tied to a specific type of learning:

1. Discovery interviews: Explore new opportunities to improve or extend the product

2. Feedback interviews: Understand pain points in real usage

3. Usability interviews: Observe how people navigate workflows

4. Validation interviews: Assess whether a concept solves the problem

Clarifying your learning goal will help you decide who to talk to, what to ask, and how to analyze what you hear. This is how you elevate individual conversations to truly hear the voice of the customer — a collective understanding that informs your product strategy.

Let's walk through each category in depth.

1. Discovery interviews: Explore opportunities and future product ideas

Expansion opportunities often show up in edge cases or from people using the product in ways you did not anticipate.

When your goal is to explore new directions or expand what exists, talk to a wide range of customers. Power users can reveal advanced edge cases. Less engaged users might surface gaps, unmet needs, or reasons for drop-off. A variety of perspectives helps you spot patterns and spark new ideas.

Here is a category breakdown:

Goal: Generate new ideas or explore ways to extend your product.

Who to talk to: This includes a range of customers — from power users to first-timers. It also includes potential users who match your target personas, but have not adopted the product yet.

What to look for: Seek out people who have used the product in different ways or who represent your ideal future customer. Include these interviews at key lifecycle moments, such as new signups, upcoming renewals, or recent churn.

Pro tip: Ask CS or sales who stands out — especially people who see things differently or push use cases beyond the core.

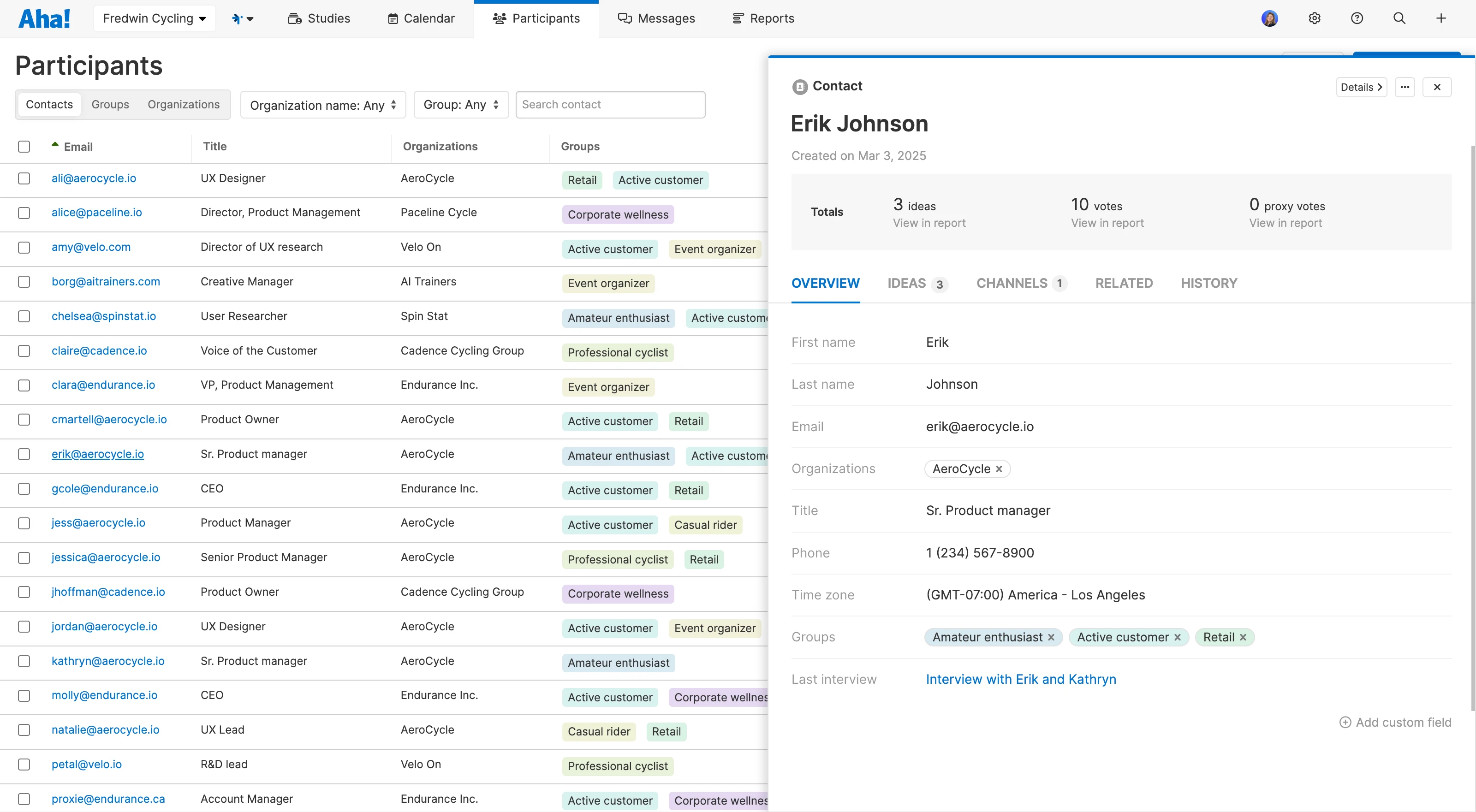

In Aha! Discovery: Use tags to group participants by usage patterns or engagement level. When you are ready to explore new opportunities, you can easily invite a balanced mix of folks to your study.