How to analyze user interviews

The best way to review and share what you learn from customer interviews

Last updated: May 2025

Customer interviews are precious. Someone taking time out of their day to share their experiences, wants, and frustrations so you can find insights that help you improve and deliver what users need? It is truly a gift. There is no substitute for this kind of product discovery.

The conversation is usually the fun part. You are engaging directly with real people who use (or who represent folks who will use) your product. With the right questions and interview techniques, you can get into a flow that encourages people to keep talking and sharing helpful tidbits.

But after the interview? Well, the sheer volume of what you are left with can be daunting. This is especially true if you are working on a significant customer research project and have dozens of sessions to comb through — but even a few user interviews can seem like a mountain of information you must sift through to find gems.

To extract real learnings and new ideas, you need to create structure around the process of transcribing, reviewing, and synthesizing user interviews. This guide covers some of the best ways to mine customer interviews for insights, including:

How to set product discovery best practices

Every organization approaches customer research a little differently. Some engage in continuous discovery and hold weekly user interview sessions. Others choose to engage customers at key points within the product development lifecycle as part of planning for and delivering major new functionality.

Whatever timeline your organization follows, a consistent approach is critical to making the most of your product discovery activities. What matters is that you have considered and documented the way you do it and that the team is equipped to make the most out of every research study — with access to what they need to leverage findings into actionable next steps.

Related:

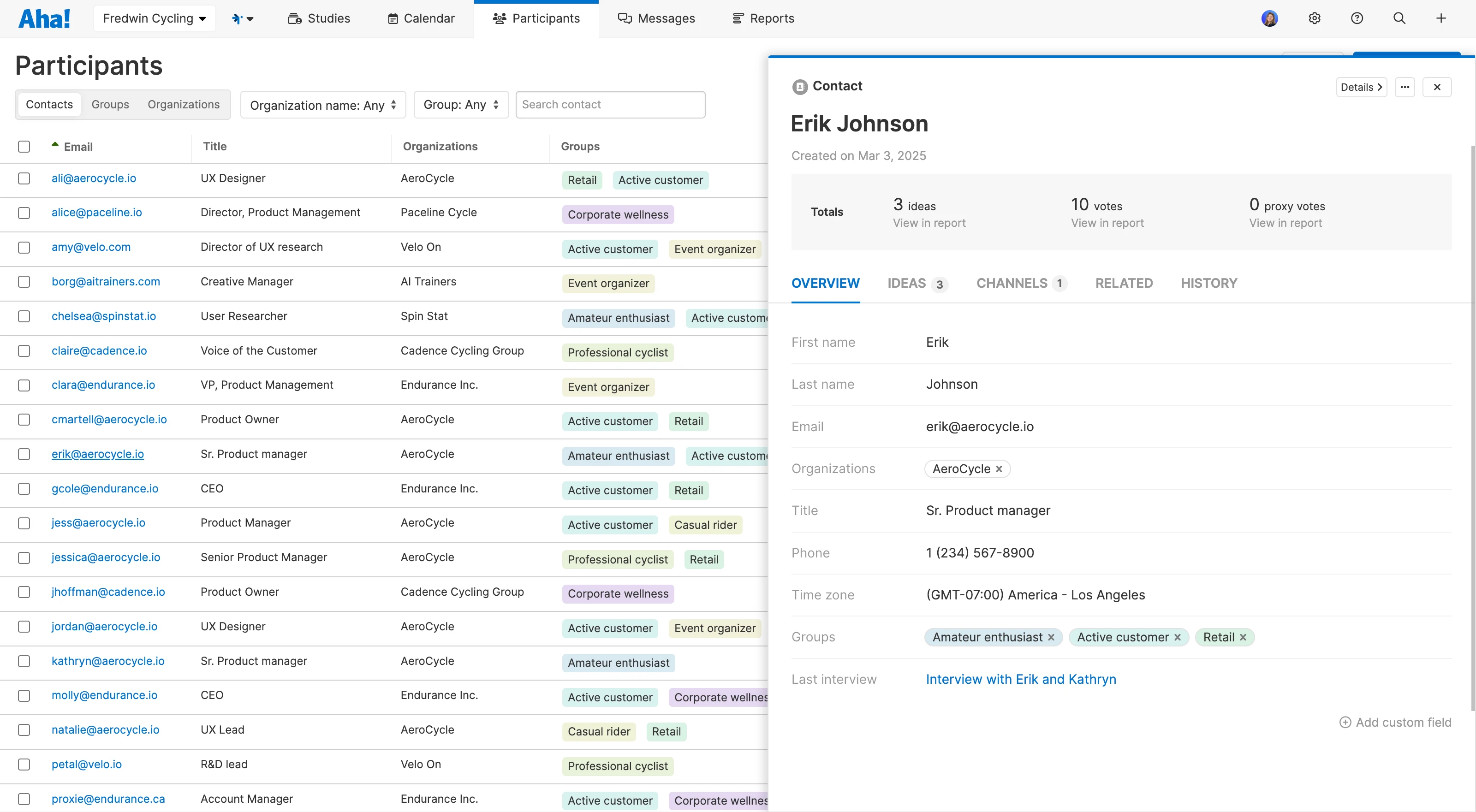

Create a research center

Start by setting up a system to organize both research insights and the people you want to learn from. This includes clear guidance for product and UX managers on how to run interviews, where to store findings, and how to maintain a customer database with folks who could participate in future conversations. Easy access to the right information — and the right users — ensures valuable insights are never lost in a sea of documents and recordings.

Build a customer database in Aha! Discovery to track conversations and manage who to engage next.

Related:

Invest in transcription services or software

Manually transcribing user interview content, whether audio or video, is tedious and a waste of the team's time. (You could be interviewing more customers instead.) There are a variety of transcription services that convert speech to text. You upload your file and quickly receive a written version.

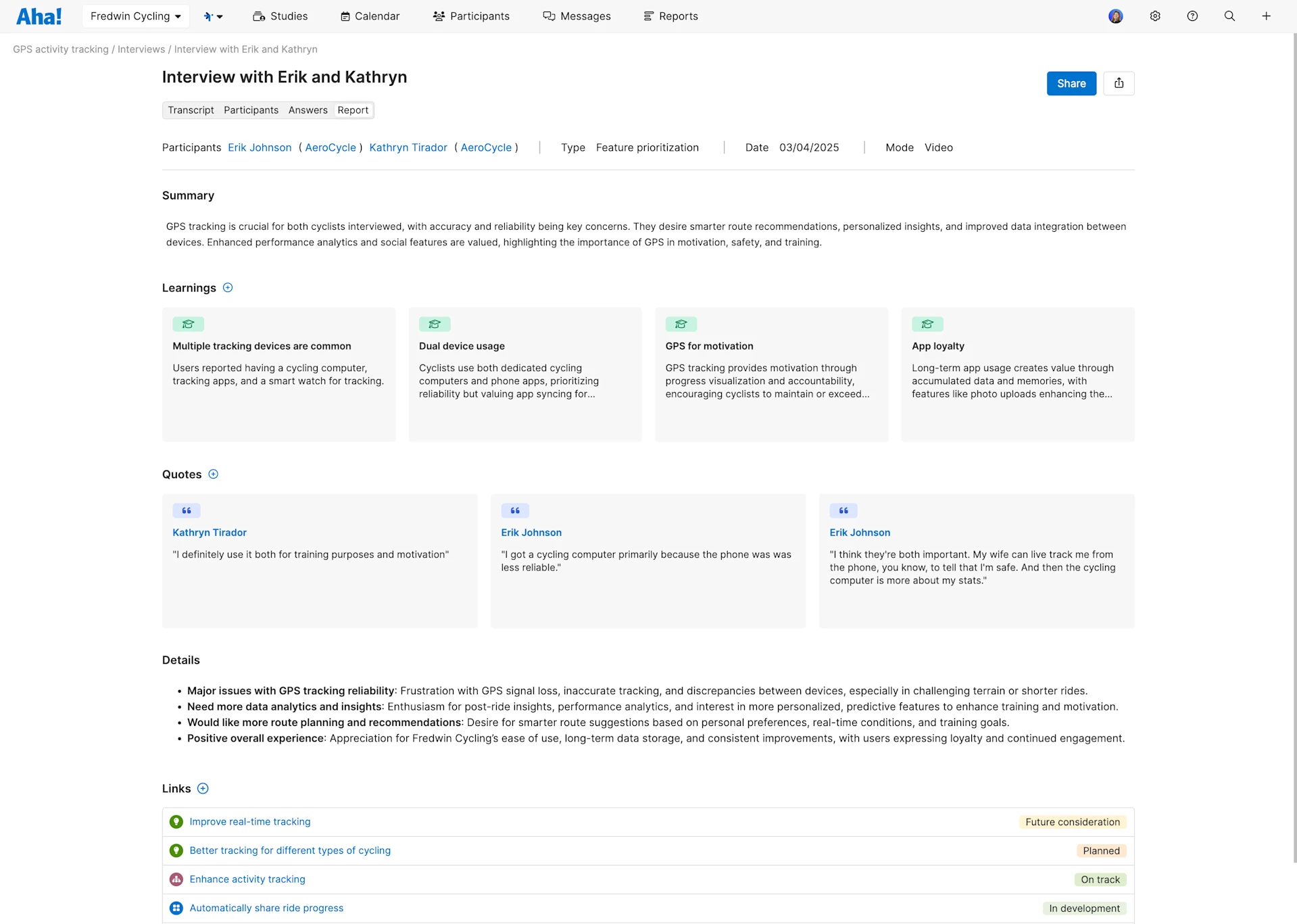

Unfortunately, a lot of these transcription services deliver the text in a raw format. Although this option is certainly better than transcribing yourself, you still have to do a lot of work to parse the content. There is purpose-built product discovery software that can help, such as Aha! Discovery, which has an AI assistant that transcribes and summarizes content for you.

Related: Getting started with Aha! Discovery

Techniques for analyzing user interviews

Raw transcripts of customer interviews are overwhelming. You are usually interviewing a few people at a time and may have held several sessions. And, as you will find, humans do not speak in perfect sound bites. Most folks tend to jump from one concept to another in the span of seconds, especially when they are trying to describe a challenging situation or convey a complex experience.

Because of the nonlinear nature of interviews, you cannot skim the text. You will need to read the long-form transcript. (Even the best product discovery software cannot do that for you.) But there are some proven techniques that you can employ to help you find the actionable insights you need. Below are four best practices for analyzing user interviews.

1. Digest the long-form transcript

When you are actively interviewing someone, you want to be engaged and responsive. It is impossible to remember the gist of everything that was said. So it is important afterward to immerse yourself in the customer interview content to be sure that you have a solid grasp of what was actually discussed. Yes, you do have to read the whole thing. (And you should probably read it a few times.)

2. Annotate the customer interview

Once you feel that you have a comprehensive understanding of what was said, you can begin to annotate the user interview. You will need to carve up the content into bits and pieces for different uses. And since people do not tend to converse in a linear way (as we noted above), you need to slice and dice everything into the types of content you need.

Here is how to annotate a customer interview:

Identify answers to questions: Look for clear-cut statements that address specific questions from your interview script.

Highlight important quotes: Search for sound bites that could be helpful to share with stakeholders and the product team, or even to use in marketing materials.

Pull out learnings: Pinpoint new information you learned during the interview so you can refer back to it and share with the team.

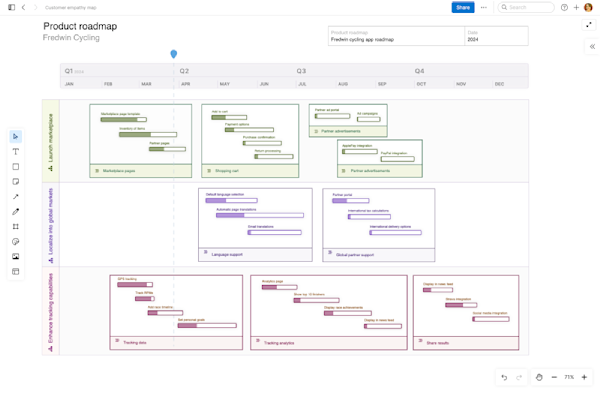

Align with your roadmap: Link answers, quotes, and learnings to upcoming or in-progress work.

For that last bullet, it helps if your product discovery process is tightly integrated with your product plans. If you use comprehensive product development software, you can easily connect discovery to your roadmap and quickly convert insights into actionable work items.