How product managers should research competitors

Competition is healthy. It motivates you to constantly find new ways to differentiate, meet customer needs, and ultimately deliver a better product. Researching and evaluating competitors is an essential skill for any product manager. And competitive research is not just about pricing structures and feature lists — it is about deeply understanding the market that you operate in and the unique value that you provide.

Competitive research is a key step in the strategic planning process. You need to know where your product fits in the market and what opportunities exist before you can set goals and prioritize what to build next.

Read on to learn more about:

Conduct competitor analysis in Aha! Roadmaps. Sign up for a trial.

What is competitor analysis?

Competitor analysis (also called competitive research) is the process of assessing the strengths and weaknesses of companies offering products similar to yours. This research can help you confirm your competitive differentiation — the unique value you offer and how your product stands out from others like it.

Before you get into the details of each competitor, spend time researching the market landscape. A thorough market analysis confirms customer needs, industry changes, and fiscal opportunity. It is this level of understanding that will allow you to act on your competitive research.

Questions to answer during the market research phase:

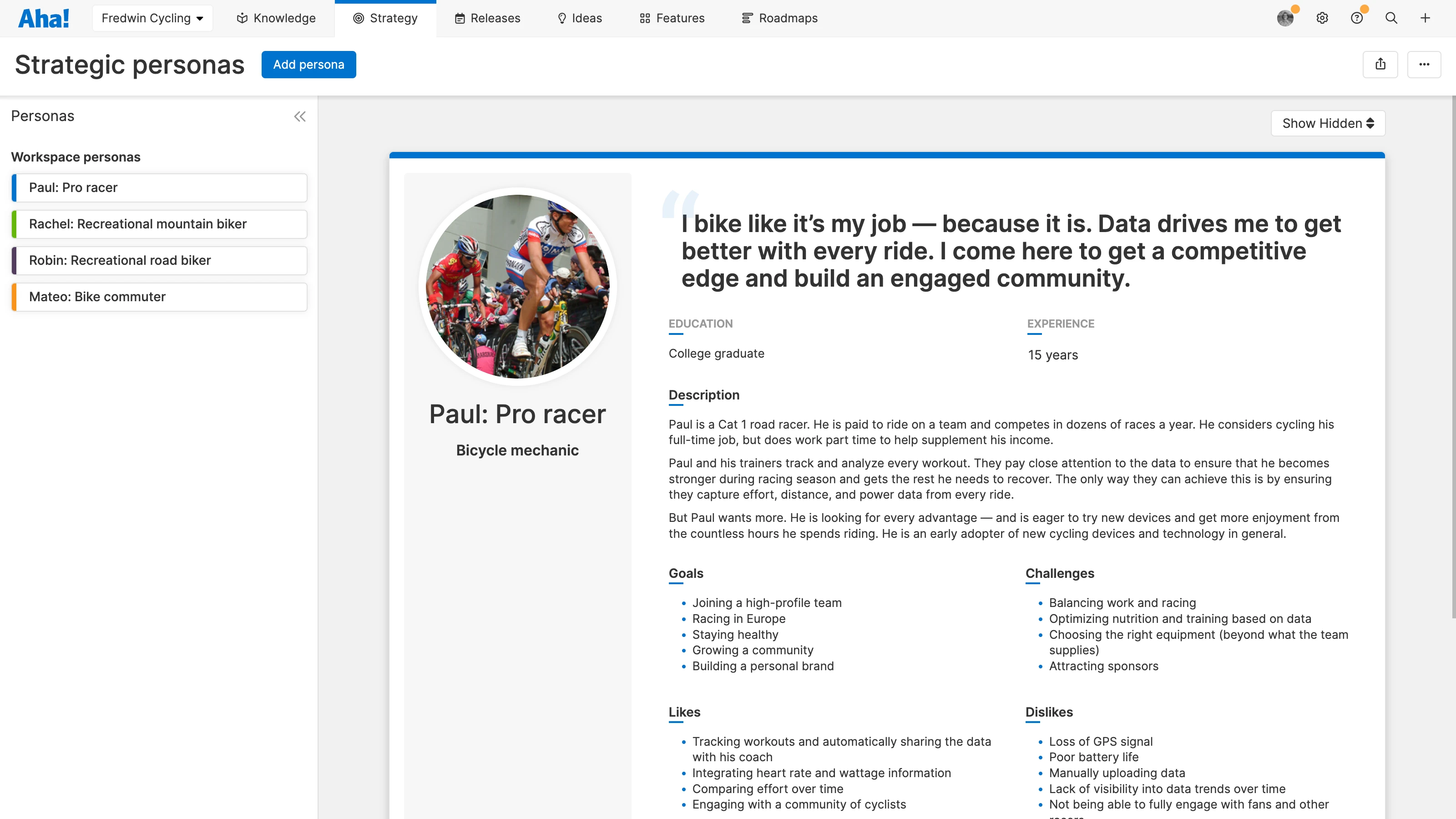

Who is your ideal customer?

What is the size of the market of ideal customers?

How has this market changed in recent years and where is it headed?

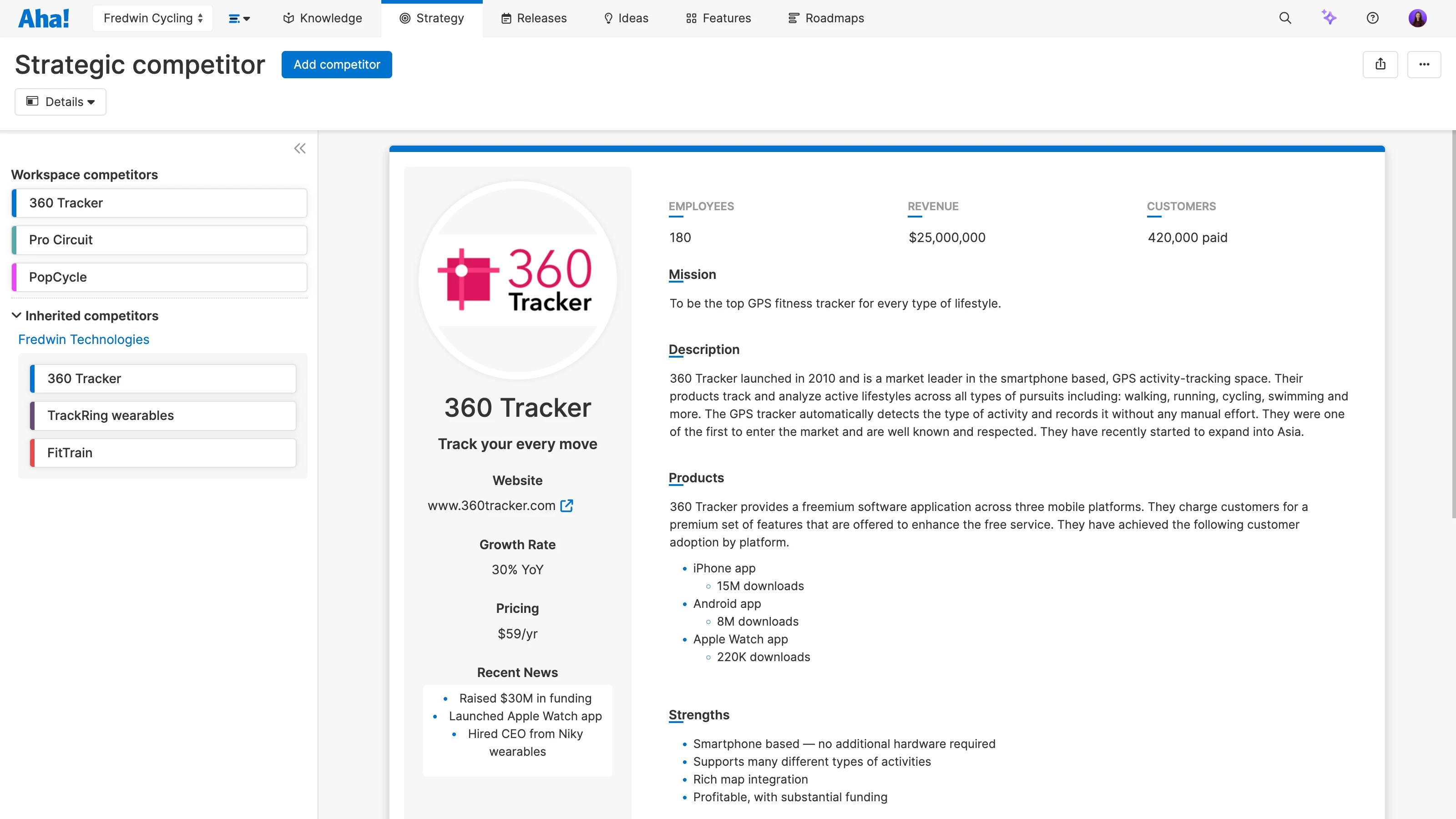

After defining the current market landscape, you can move on to examining your competitors. A thorough competitor analysis requires exploration of a wide range of sources for each competitor — everything from product reviews and sales collateral to press releases and revenue details. And you should also get firsthand experience in each product so you can see for yourself how they compare to your own.

Competitor analysis can help answer these core questions:

Are there other companies offering a product that provides a solution similar to ours?

Are my potential customers getting a product or service at the level that they want or need?

How can we enhance the value of our product to help it stand out in the marketplace?

Related guides:

How to perform a competitive analysis

Before we get into the details, here are the basic steps you will follow to perform a competitive analysis. Consider collaborating with your product marketing team — they conduct similar research and will likely be able to share insights into customers that can help guide your efforts.

Follow these steps to conduct a thorough competitor analysis:

Establish a list of direct and indirect competitors.

Examine available research materials — such as the company's website, customer reviews, financial information, and press releases.

Test the products yourself, if possible.

Briefly document user experience (UX), functionality issues, and any information relevant to your target customer.

Identify product strengths and weaknesses based on customer reviews.

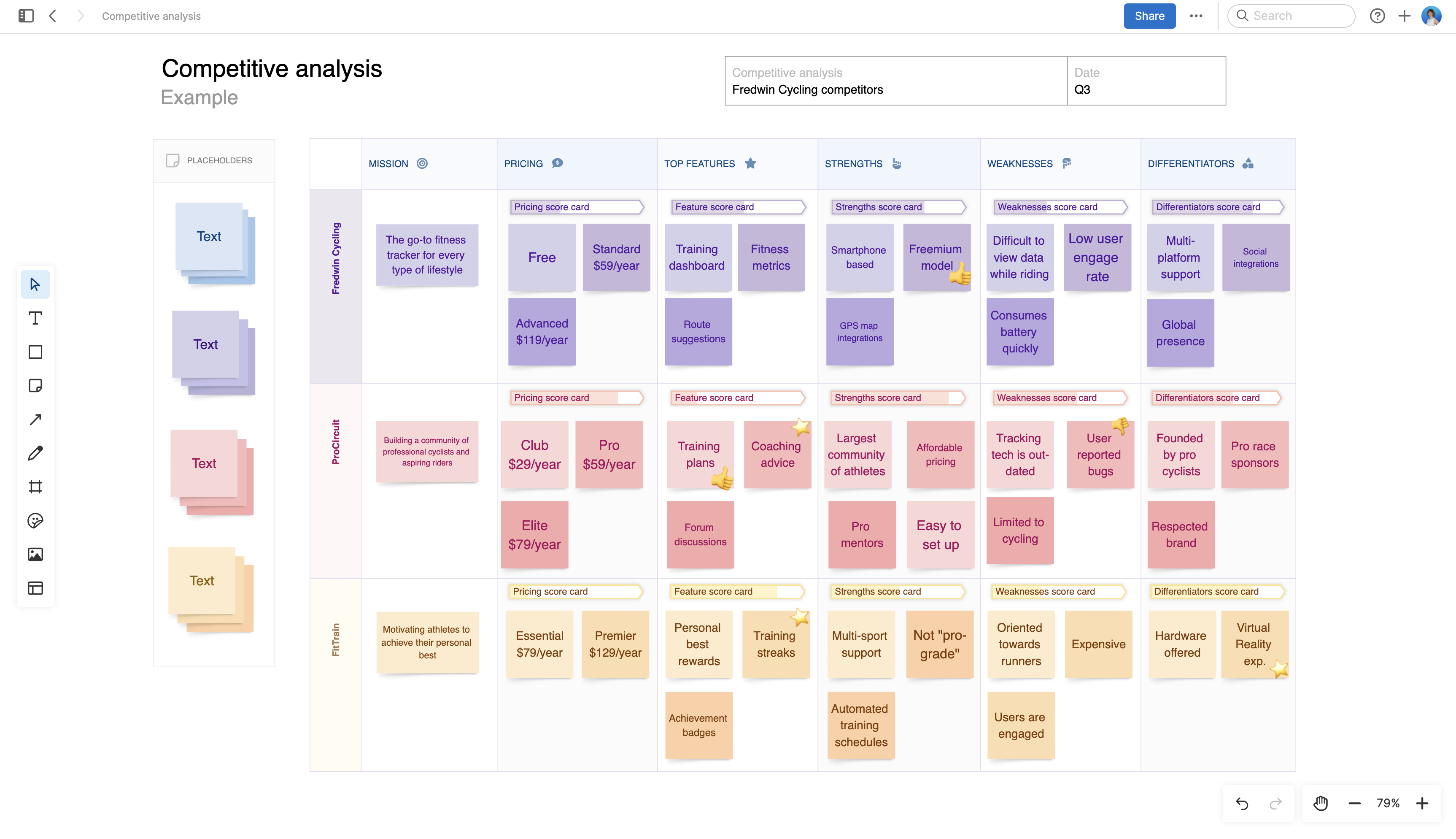

Create a competitive analysis report. These templates provide a good starting point.

Share your report with the product team and others in sales and marketing

As you go along, it can be helpful to use a competitive analysis template to organize your observations. This whiteboard template is great for getting started quickly — it highlights several areas of analysis in one streamlined, shareable view.