How product managers should research competitors

Competition is healthy. It motivates you to constantly find new ways to differentiate, meet customer needs, and ultimately deliver a better product. Researching and evaluating competitors is an essential skill for any product manager. And competitive research is not just about pricing structures and feature lists — it is about deeply understanding the market that you operate in and the unique value that you provide.

Competitive research is a key step in the strategic planning process. You need to know where your product fits in the market and what opportunities exist before you can set goals and prioritize what to build next.

Read on to learn more about:

Conduct competitor analysis in Aha! Roadmaps. Sign up for a trial.

What is competitor analysis?

Competitor analysis (also called competitive research) is the process of assessing the strengths and weaknesses of companies offering products similar to yours. This research can help you confirm your competitive differentiation — the unique value you offer and how your product stands out from others like it.

Before you get into the details of each competitor, spend time researching the market landscape. A thorough market analysis confirms customer needs, industry changes, and fiscal opportunity. It is this level of understanding that will allow you to act on your competitive research.

Questions to answer during the market research phase:

Who is your ideal customer?

What is the size of the market of ideal customers?

How has this market changed in recent years and where is it headed?

After defining the current market landscape, you can move on to examining your competitors. A thorough competitor analysis requires exploration of a wide range of sources for each competitor — everything from product reviews and sales collateral to press releases and revenue details. And you should also get firsthand experience in each product so you can see for yourself how they compare to your own.

Competitor analysis can help answer these core questions:

Are there other companies offering a product that provides a solution similar to ours?

Are my potential customers getting a product or service at the level that they want or need?

How can we enhance the value of our product to help it stand out in the marketplace?

Related guides:

How to perform a competitive analysis

Before we get into the details, here are the basic steps you will follow to perform a competitive analysis. Consider collaborating with your product marketing team — they conduct similar research and will likely be able to share insights into customers that can help guide your efforts.

Follow these steps to conduct a thorough competitor analysis:

Establish a list of direct and indirect competitors.

Examine available research materials — such as the company's website, customer reviews, financial information, and press releases.

Test the products yourself, if possible.

Briefly document user experience (UX), functionality issues, and any information relevant to your target customer.

Identify product strengths and weaknesses based on customer reviews.

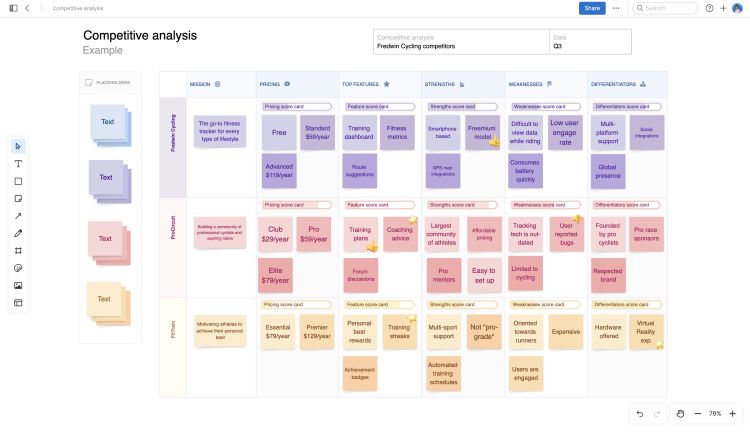

Create a competitive analysis report. These templates provide a good starting point.

Share your report with the product team and others in sales and marketing

As you go along, it can be helpful to use a competitive analysis template to organize your observations. This whiteboard template is great for getting started quickly — it highlights several areas of analysis in one streamlined, shareable view.

Identifying direct vs. indirect competitors

Before you conduct competitor analysis, you need to identify who and what your product is up against in the market. It is wise to document both direct and indirect competitors.

A direct competitor is a company that offers (more or less) the same good or service within the same market. For example, Netflix and Hulu streaming services are direct competitors.

An indirect competitor is a company that offers a different type of product to serve the same need for the same customer segment. For example, YouTube is an indirect competitor to both Netflix and Hulu.

Here are two ways to build your list of competitors:

Customer feedback: Which other products do people mention during demos or support calls? If they are a prospective customer, which product do they currently use to meet similar needs as your product? If they no longer use your product, which competitor is now getting their business?

Keyword research: This can be as simple as entering your product category (ex. "online whiteboard") into a search engine and seeing which products show up in the search results. If you have the right tools (or collaborate with a marketing team), you can also go deeper — tracking organic search rankings and which companies are vying for similar online ad placements.

Evaluating both direct and indirect competitors is a valuable exercise. Understanding the strengths and weaknesses of your direct competitors can help you discover opportunities where you can stand out and gain a market advantage. And knowing how your potential customers are using indirect competitors can highlight problems that you could potentially solve more effectively.

How should I research competitors?

Once you have identified your direct and indirect competitors, you can start gathering key information about each one. You can find this information on company websites, third-party review sites, and within industry news coverage. Take notes on what you learn — to share with your team a bit later in this process.

Here are some useful sources to include in your competitive analysis:

Source | Potential learnings |

Company websites | By carefully reviewing product pages, customer success stories, and support documentation you can learn about:

|

Firsthand product experience | Signing up for a trial account and testing competitor products firsthand is invaluable. You can get a sense for:

|

Press releases | Press releases can provide insight into how the companies behind competitive products operate. For example, press releases may report updates on:

|

Product reviews | While most company websites include positive testimonials, you will need to look at third-party review sites to understand the full range of customer experiences. Take note of:

|

Sales collateral | Sales collateral includes things like case studies, sales decks, and product videos. If you can get your hands on some of these materials, they can help you understand:

|

With your list of competitors and source materials in hand, here are some of the categories you can examine for each competitor — including key questions to guide your research:

Vision

Identify each competitor's vision — where they are headed and what they aim to achieve in the market. Most companies offer this information in some form on their website. When reviewing, assess how they present themselves to both customers and prospects. Questions to answer:

Why do these products exist?

Which problems do they aim to solve?

Are there any problems that these products do not seem to solve?

Positioning

Assess where your competitors see themselves within the shared market. The best place to find this information is in your competitors' marketing messages — anything on their own websites as well as external sites such as social media networks or industry news outlets. Questions to answer:

How do your competitors market their products?

What language do they use to describe what they offer in market?

Which core problems do they believe they solve?

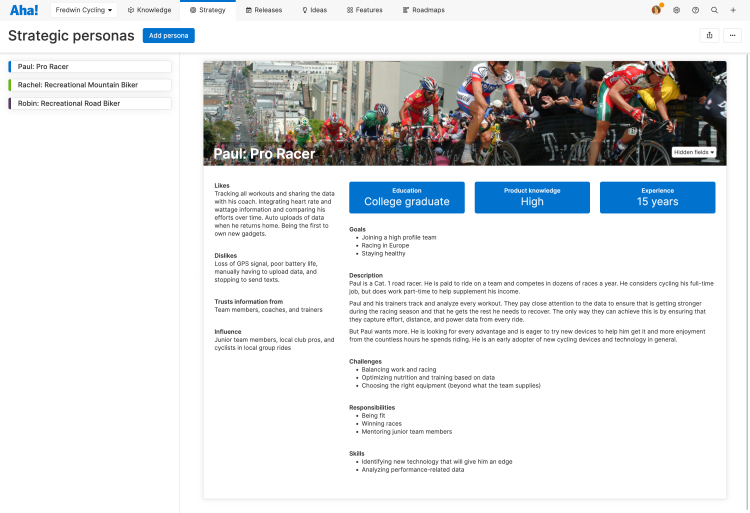

Personas

Learn about the target audience for your competitors' products. While researching competitors and using their products, try to envision their user personas — the profile of their ideal customer. And revisit customer reviews to look for patterns. Questions to answer:

What are the job titles of competitors' typical customers?

What industry do target customers work in?

What are their target customer's skills and interests?

How do their personas differ from yours?

Differentiators

Determine what distinguishes each competitor's product from yours and the rest of the market. When doing your research, focus on the factors that are most important to your customers, such as customer service, integrations, and price. Questions to answer:

What are the product's key benefits?

Is the look and feel of this product superior to mine and others on the market?

Is the price lower or higher than the rest of the competition?

Does the product work better than the rest?

Does the company offer superior customer service?

Strengths

Aim to understand what drives your competitors to do what they do and where their products stand out. Take your competitors' product tours or even sign up for a free trial to understand all aspects of their offerings. Also look up the companies' founders on LinkedIn — many products are built out of deep, personal passion. Questions to answer:

What does the competition excel at?

What do they do better than you?

What unique insight and experience do the company's founders offer?

Weaknesses

You can also spot weaknesses in product tours or while experimenting in a free trial. You can gain the customer perspective by searching relevant online forums for reviews and insights on these products. Quora, Product Hunt, and LinkedIn are three potential platforms that offer unbiased opinions on what customers and prospects think. Questions to answer:

What do competitors' users struggle with?

Which aspects of these products are lacking?

What customer needs are these products failing to meet?

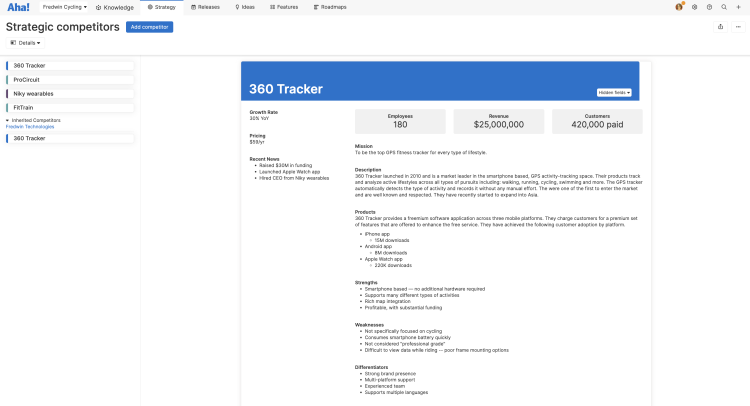

Document your findings in a central location that your team — and other teams such as sales and marketing — can access. A competitive analysis template can help keep everything clearly organized. Excel spreadsheets or PowerPoint documents are a good start. But many product teams also use tools like Aha! Roadmaps to document competitive research as a part of strategic product planning. This ensures that your research informs your goals, initiatives, and tactical work.

While competitive analysis is a key component of any good product strategy, it is important that you treat it as just a guideline. You should never make decisions about your product based solely on a desire to get ahead of your competitors. Instead, use your research alongside what you know is best for your customers and company to inform your decisions. Staying focused on what your customers need and want will help you successfully create value for your business and your customers.

Plan today what you will achieve tomorrow. Aha! Roadmaps can help.